In the early 19th century, the French mathematician Joseph Fourier discovered the greenhouse effect, which laid the foundation for understanding the Earth's climate system. The theory revealed the mathematical principles of heat transfer and was closely linked to the global climate change challenge more than a hundred years later. In 1994, the United Nations Framework Convention on Climate Change entered into force, prompting countries to gradually advance energy transitions. China's "dual-carbon" goals, the EU’s climate law and the US Net-Zero Greenhouse Gas Emissions strategy together outline a future of clean energy. With the popularization of new energy vehicles (NEVs), new energy batteries have become critical, but they face challenges such as range anxiety, charging speed, and lifespan, urgently requiring solutions of battery digitalization and artificial intelligence technologies, i.e. smart batteries.

Smart batteries refer to the integration of big data, the Internet of Things (IoT), artificial intelligence (AI), and other technologies to achieve autonomous perception, analysis, and optimization of data in the battery lifecycle. With the rapid development of AI, this concept has been brought up by several organizations. For example, the International Energy Agency (IEA) emphasized in its Global EV Outlook 2023 that power batteries need to possess "AI-driven self-optimization" capabilities to enhance energy efficiency and lifespan. China's Ministry of Industry and Information Technology (MIIT) also specified in its Smart Photovoltaic Industry Innovation and Development Action Plan that power batteries should achieve digital, networked, and intelligent transformation, covering the entire chain of "manufacture-application-recycle". In today's fast-developing new energy field, smart power batteries are gradually becoming a key force in promoting industry innovation and transformation.

This article will explore the development history of smart power batteries based on patent data and market analysis, and provide insights into future technological and market trends in the industry.

I. Global and China Patent Application Trends

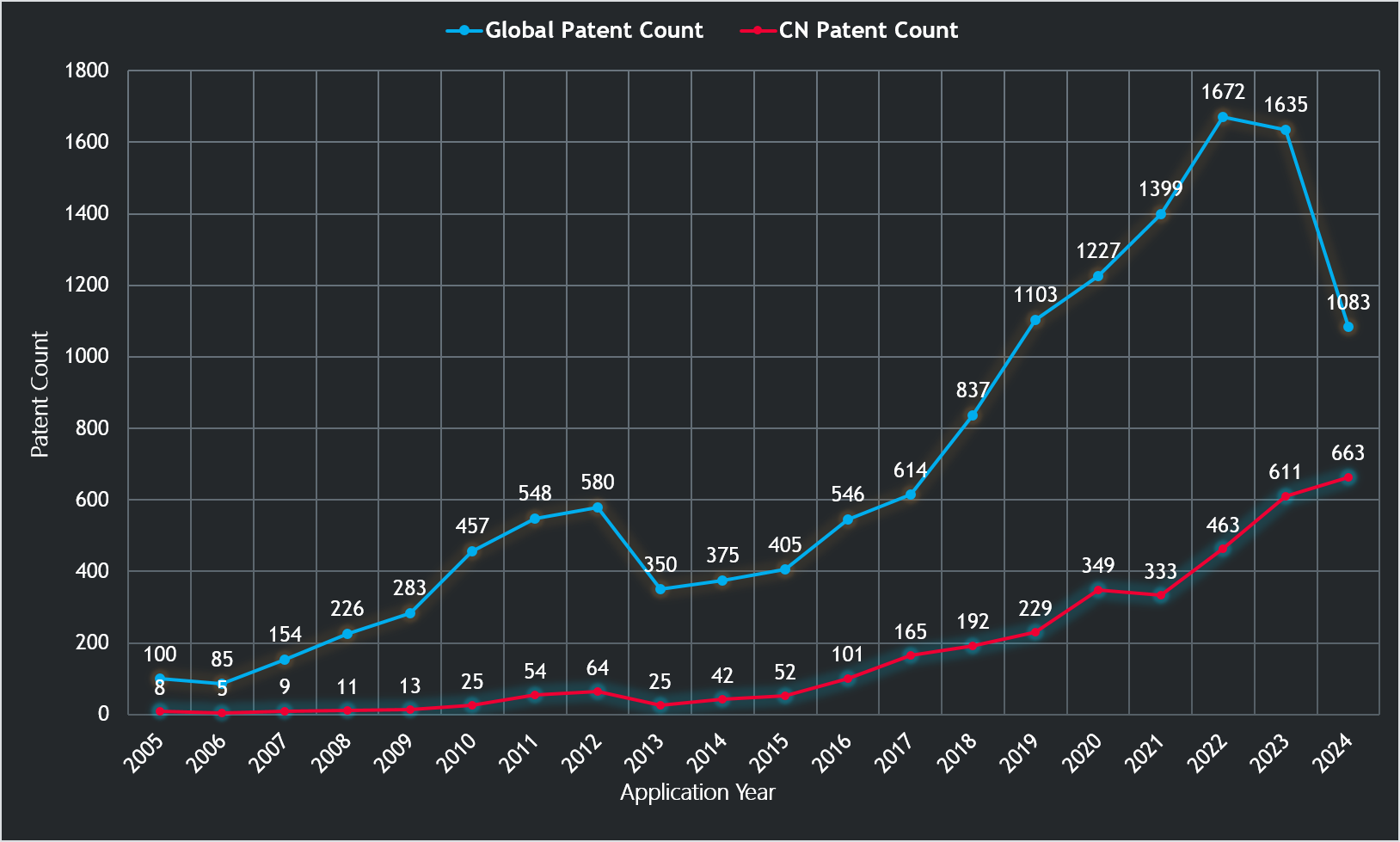

Figure 1. Global and CN patent application number by year

Figure 1 illustrates the trend of patent application in this field over the past two decades. From 2005 to 2017, the number of patent applications in this field grew gradually from 100 to 614. Despite fluctuations, the overall trend was steadily upward. From 2018 to 2023, there was a significant growth, reaching a peak of 1,672 in 2022. Due to the lag in patent publication, actual application number in 2022–2024 may be much bigger than the ones shown here. Overall, these data reveal the trend of the smart power battery technology over the past two decades, from initial exploration to rapid development, demonstrating the sector's sustained innovative potential.

As shown in Figure 1, China's patent application trend is largely consistent with global trend, also showing a significantly increasing overall trajectory. From 2005 to 2008, China's patent applications grew slowly. In March 2009, the General Office of the State Council of China released a plan for the adjustment and revitalization of the automotive industry, which pointed out that initiating a national energy saving and NEVs demonstration project with subsidies allocated by the central government. In the same year, the Ministry of Finance also issued the notice on carrying out pilot projects for the demonstration and promotion of energy saving and NEVs, explicitly subsidizing the purchase of NEVs in public service sectors of pilot cities which marks the beginning of China's NEVs subsidy era. As reflected in the number of patent applications for smart power batteries, applications increased from 13 to 64 between 2009 and 2012, indicating China's gradual increase in R&D investment in this field.

From 2013 to 2017, China's patent applications grew steadily from 25 to 165. In 2016, China's lithium batteries consumption share first reached 50% in the global market, and it has since remained the world's largest lithium batteries consumer market[1].

From 2018 to 2024, patent applications continued to grow from 192 to 663, a particularly significant growth demonstrating China's sustained investment and innovation capability in the industry. The brief decline in 2021, however, may be due to the impact of the COVID-19 pandemic, while the strict nationwide epidemic prevention measures affected economic and corporate activities.

Finally, what distinguishes China's 2023–2024 patent application trends from global trends is that while publication lags exist in both data sets, China's applications continued to grow while the global data declined, indicating a strong momentum of development and technological innovation in this field in China.

Figure 2. CN patent application origin countries

In another perspective, the top five assignee (applicant) origin countries for CN patent application over the past two decades are Japan, China, the US, South Korea, and Germany (see Figure 2). According to 2024 global power battery sales data[2] and the list of the top 10 global power battery manufacturers by sales, the six Chinese battery manufacturers among the top 10 saw their combined global market share rise to 67.1%. However, in the view of patent portfolio in smart power batteries, China did not rank first. In contrast, Japanese battery manufacturers hold 23.85% of patents while only one Japanese power battery manufacturer ranked in the top 10 of 2024 global power battery sales data with its market share declining from 6.1% in 2023 to 3.9% in 2024. At least in the field of smart power batteries, Chinese companies' technological accumulation through patents is disproportionate to their market position.

II. An In-depth Study of China's Patents in Smart Power Batteries

Figure 3. CN patent application number by year

The total number of patent applications for smart power batteries in China analyzed in this study is 3,414, of which 125 are PCT international patent applications filed with the National Intellectual Property Administration (CNIPA) as the receiving office. As shown in Figure 3, the number of PCT patent applications from China first exceeded 10 in 2018 and reached 30 in 2021.

Figure 4. CN patent number of top 20 companies

As shown in Figure 4, the top 20 patent assignees[3] (excluding assignees from universities) hold about 922 patents among the 3,414 patent applications, accounting for 27% of the total. The top 20 assignees (applicants) are from China, Japan, South Korea, the US, and Germany, with 35% of patents held by Chinese domestic enterprises.

Figure 5. Patent application number by year of top 5 technology origin countries

In the 3,414 patents for smart power batteries in China, the top five technology origin countries (China, Japan, South Korea, the US, and Germany) account for 3,344 applications, or 98% of the total (see Figure 5), indicating a highly concentrated competitive landscape and technological innovation in the field, with R&D and innovation dominated by enterprises from those five countries. Over the past two decades, 71% of China's smart power battery patents was filed by domestic enterprises.

Figure 6. Family number of patent from top 5 technology origin countries

An important invention is often filed in multiple countries, and these identical applications in different countries together form a simple patent family. Figure 6 shows the proportion of simple patent family size among the top five technology origin countries. While 95% of patent families from Chinese assignees consist of only 1–5 members, their counterparts in Japan, South Korea, the US, and Germany see over 20% of families with 6–10 members. Additionally, US applicants have 12.72% and 4.95% of families with 11-50 and over 51 members, respectively, which is far higher than other countries. This indicates that Chinese domestic enterprises place less emphasis on global patent portfolio compared to foreign counterparts.

III. China's Patents Illustrates Key Tech Trends

Based on thorough reading of all CN patents, main research directions and advancements in the smart power battery are identified:

Capacity and Lifespan Optimization: trained on extensive experimental datasets, AI models can deliver much accurate predictions to optimize battery charge-discharge cycles and extend operational lifespan.

Safety Improvement: smart technologies plays a role in predicting and preventing safety issues such as battery overheating, overcharging, and over-discharging, including real-time monitoring of battery status and measures to prevent potential hazards.

Battery Diagnostics and Health Management: online diagnostics and health management of battery systems, with real-time monitoring helping detect internal issues and take preventive measures before problems arise.

These smart power battery innovations are powered by big data analytics, cloud computing, IoT, and AI algorithms.

Big data serves as the foundation, collecting and processing massive operational datasets to enable accurate model training. For example, CN118311465B for battery health detection utilizes user behavior and battery operation data by applying big data technologies to build battery health assessment models. Similarly, CN117317408A connects to a big data platform to obtain and filter power battery data for neural network training, establishing a lifespan prediction model and providing high-quality data for subsequent AI analysis. CN109604192A proposes a battery sorting method and system based on big data analysis to improve sorting accuracy and efficiency through large-scale data analysis, ensuring battery consistency and reliability.

Cloud computing and IoT technologies act as bridges for data transmission and processing, responsible for real-time transmission of battery data to the cloud for analysis and returning results to the battery management system. For example, CN119099430A for vehicle-cloud collaborative thermal runaway warning relies on IoT technologies to collect and transmit data and cloud computing for data analysis and processing to enable real-time monitoring and early warning of battery status. CN116176341A discloses an electric vehicle charging pile safety management system that collects electrical characteristics and charging line temperature data during charging via acquisition modules, uploads them to a cloud server, analyzes and compares the data based on kernel density feature models for safety monitoring, and automatically controls power-off and alarms in case of hazards.

AI algorithms are the core of data processing and decision-making, using big data for deep learning and prediction. For example, CN117907872A applies pre-trained models to power battery parameter data (e.g., voltage, current, temperature, cycle count) to accurately predict remaining battery life, supporting equipment operation and lifespan extension. CN117317408A uses deep learning models to estimate and predict battery status (e.g., charge level, remaining life, health status) to provide decision-making bases for optimized battery management. CN110525269B employs model predictive control algorithms to improve inconsistency among battery cells, reducing balancing time and energy consumption.

In summary, big data provides the data foundation, cloud computing and IoT enable data transmission and processing, and AI algorithms conduct data mining and decision support. Their synergistic effect drives the development of smart power battery technologies, enhancing battery performance, safety, and lifespan.

IV. Conclusion

At the 2009 Copenhagen Climate Conference, negotiators from 192 countries debated fiercely for 12 days but failed to produce a legally binding document. Ding Zhongli, then Vice President of the Chinese Academy of Sciences and a scientific advisor to the Chinese delegation, stated in a post-conference interview: "Developed countries' emission reduction plans ignore historical responsibilities, fairness, and human rights, which are the main reasons for the failure to reach consensus.…" In a 2021 interview with CCTV, Dr. Ding expressed confidence in China’s emission reduction efforts despite low expectations for developed countries' implementation of their plans, asserting that "technology is king" in the path toward carbon neutrality.

Reducing fossil fuel use to mitigate the greenhouse effect has become a global consensus, requiring strong technological support. The most effective way to abandon traditional means is to find better alternatives. With China’s clear long-term goal of achieving a non-fossil energy consumption share exceeding 80% by 2060, the dominance of electric vehicles is inevitable. Smart power batteries represent a critical technology to address current challenges such as EV range, battery safety, and lifespan, while enhancing battery performance. In the foreseeable future, R&D in smart power batteries will remain highly active. The Chinese market is full of opportunity and will always reward innovative players.

脚注:

[1] China Lithium Industry Development Index White Paper issued by MIIT in May 2022.

[2] Published by SNE Research, 2025 Jan Global Monthly EV and Battery Monthly Tracker : https://www.sneresearch.com/en/insight/release_view/371/page/0.

[3] Patent assignee data was from the query of "Std. Current Assignee", which refers to the standardized result of the original applicant/right holder names in the PatSnap patent database, designed to improve search comprehensiveness. For example, if a company uses non-standard names in patent applications, the database standardizes them for easy identification. Standardization involves unifying names across multiple dimensions (e.g., punctuation, capitalization, abbreviations, full names, translation methods, company suffixes) without merging subsidiaries and parent companies, facilitating viewing and analysis.

Source: King & Wood Mallesons

Authors:

- Ma Junhao, Senior Counsel, Intellectual Property, majunhao@cn.kwm.com, Areas of Practice:Intellectual property matters and technology trade

- Cao Wenjing, Patent Analyst, Intellectual Property