Over the past couple of decades, China has been dedicated in broadening market access, lifting restrictions, and facilitating foreign investment. The General Office of the State Council has issued an action plan early this year aiming to encourage foreign investment, which provides, including among others, the following measures:

-

to broaden market access: expanding pilot opening-up programs in telecommunications, healthcare, education, and other sectors, lifting all restrictions on foreign investment in manufacturing sector, and promoting the orderly opening up in the biomedical sector;

-

to promote foreign investment: encouraging foreign investors' equity investments in China (including removal of the restrictions on foreign-invested holding company's use of domestic loans in equity investments thereby smoothing set-up of regional headquarters by MNCs in China); supporting re-investment by foreign invested enterprises ("FIEs"); and facilitating foreign investors' merger and acquisition in China; and

-

to facilitate operations: offering more convenient measures to ease personnel entry and exit and trading business of FIEs.

The Hainan Free Trade Port (the "Hainan FTP"), positioned as the policy frontier, features notable highlights in expanding market access for foreign investments, refining foreign investment promotion measures, and improving foreign investment services. The Regulations on Foreign Investment in the Hainan Free Trade Port (《海南自由贸易港外商投资条例》, the "Regulations"), enacted on July 30, 2025, together with other existing and latest issued policies in Hainan FTP, implement those action plans in a proactive manner.

Ⅰ. Expanded Market Access and Participation

1. Hainan FTP – the Shortest Negative List

The Foreign Investment Law of the People's Republic of China (《中华人民共和国外商投资法》), effective from January 1, 2020, established the legal regime of pre-establishment national treatment plus negative list for foreign investment. "Pre-establishment national treatment" guarantees that foreign investors will receive treatments no less favorable than those being granted to domestic investors in terms of investments in China. The "negative list" sets forth certain sectors access to which by foreign investors may be forbidden or subject to restrictions, while regarding any sector out of the "negative list", foreign investors will be granted national treatment.

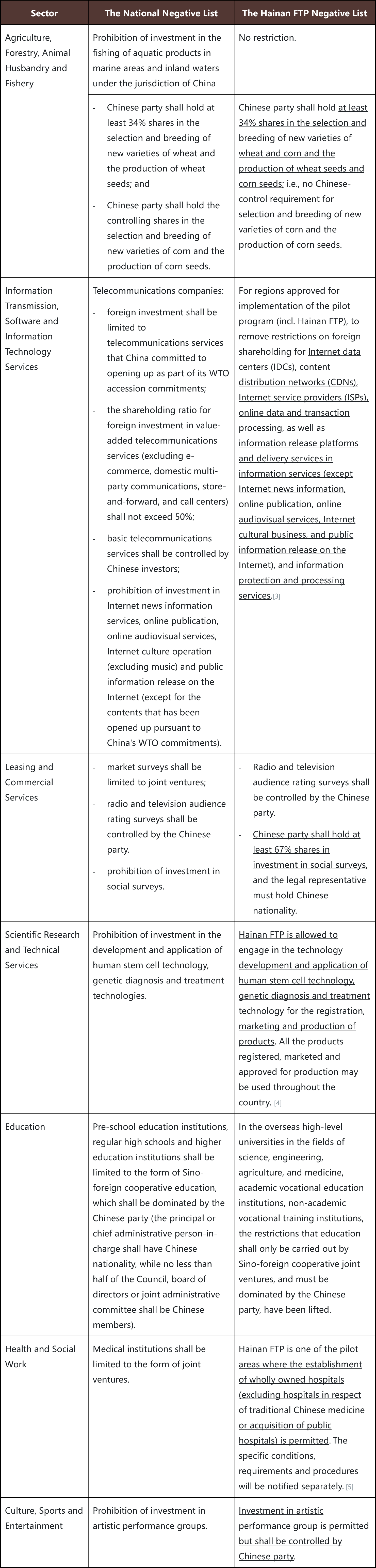

Compared with the Special Administrative Measures (Negative List) for Foreign Investment Access (2024 Version) (《外商投资准入特别管理措施(负面清单)(2024年版)》) (the "National Negative List")[1], the Special Administrative Measures (Negative List) for Foreign Investment Measures in Hainan Free Trade Port (2020 Version) (《海南自由贸易港外商投资准入特别管理措施(负面清单)(2020年版)》) (the "Hainan FTP Negative List")[2] together with the Regulations further lifts restrictions in the following sectors:

2. Encouraged and Signature Industries in Hainan FTP

Hainan FTP will focus on development of certain key industries, such as tourism, modern service industry, high-tech industry and tropical specialty high-efficiency agriculture. The Regulations further propose to encourage foreign investment in seed industry, marine, aerospace, digital, and green low-carbon sectors. Below we set forth certain industries or business where the Regulations intend to encourage foreign investment in the Hainan FTP:

-

to support qualified overseas securities, fund and futures institutions in establishing wholly-owned or joint-venture financial institutions in the Hainan FTP;

-

to support foreign institutions to establish reinsurance companies or branches in the Hainan FTP, and to support cooperation in development of cross-border medical insurance products by insurance financial institutions and foreign institutions;

-

to support foreign investors and FIEs to set up and develop foreign-invested R&D centers in the Hainan FTP, to cooperate with colleges and universities, scientific research institutions and other enterprises in technological R&D and the implementation and transformation of scientific and technological achievements;

-

to encourage foreign investors and FIEs to establish open innovation platform in the Hainan FTP;

-

to support MNCs to set up cross-border treasury operation centers in the Hainan FTP;

-

to encourage foreign investors to set up regional headquarters and other functional organizations in the Hainan FTP.

3. Diversified Approaches for Foreign Investment

In addition to foreign direct investment via establishing business presence in China, Hainan FTP is open to diversified approaches for foreign investment:

(1) Foreign Direct Investment ("FDI")

FDI, the most typical and common way for foreign investors making investment in China, which usually manifests in establishment of FIEs (either wholly-owned enterprises or joint ventures) or acquisition of domestic enterprises. Foreign investors may also reinvest in other domestic entities via their existing FIEs or establish holding companies dedicated in making equity investment in China.

(2) Qualified Foreign Limited Partner ("QFLP")

QFLP, subject to qualification approvals and foreign exchange regulatory procedures, offers a way for foreign investors to invest in PRC domestic private equity market. Typically, the structure of QFLP consists of foreign investors serving as the limited partner, who may make capital contributions in RMB or foreign currency, and a domestic or foreign private fund management enterprise serving as the general partner to manage and operate the fund/partnership.

Compared with FDI, to set up a QFLP is subject to regional QFLP pilot policies available in pilot areas and requires application for pilot program approval. Nevertheless, QFLP provides manifest advantages in terms of foreign exchange. FDI requires foreign exchange registrations at the FIE level upon establishment, change, exit and use of registered capital denominated in foreign currency, while the QFLP mechanism allows the fund/partnership to convert its capital denominated in foreign currency into RMB on a one-off basis and use RMB for equity investments in China.

So far, more than 30 provinces and municipalities have implemented QFLP pilot policies. Compared with other provinces and municipalities, Hainan FTP's QFLP pilot policy[6] has its unique advantages in terms of establishment threshold, establishment procedures and scope of investment. The Regulations also provides that Hainan FTP shall continue to simplify the procedures for establishing QFLP funds and corresponding foreign exchange registration procedures.

(3) Hainan Cross-border Asset Management Pilot Program

On July 21, 2025, the People's Bank of China Hainan Provincial Branch and four other authorities jointly issued the Implementation Rules for the Pilot Program of Cross-Border Asset Management in Hainan Free Trade Port (《海南自由贸易港跨境资产管理试点业务实施细则》, the "Pilot Program"), according to which, eligible overseas institutional investors and overseas individual investors may invest directly in asset-management products issued by financial institutions located in the Hainan FTP, including among others, wealth-management products, private asset-management schemes offered by securities, fund and futures institutions, public securities investment funds, and insurance asset-management products. The Pilot Program will take effect on August 21, 2025.

The Pilot Program distinguishes itself from other existing cross-border asset management products (such as QFII/RQFII, QFLP, CIBM Direct, Bond Connect, Stock Connect and the Cross-boundary Wealth Management Connect Pilot Scheme in the Guangdong-Hong Kong-Macao Greater Bay Area) in terms of the following investor-friendly measures: (1) lower entry barrier - the Pilot Program is a unilateral opening and does not impose any geographic restrictions; (2) wider range of asset-management products - the Pilot Program has expanded the scope of asset-management products to cover public securities investment funds with risk rating of "R1" to "R4", private asset-management schemes with risk rating of "R1" to "R4", insurance asset-management products and any other products approved by the competent authorities; and (3) expanding investor base to foreign individual investors (i.e. foreign nationals studying, working, or residing in Hainan FTP, or high-end talents and urgently-needed talents certified under talent policies of Hainan FTP).[7]

Ⅱ. Facilitated Foreign Investment Promotion Measures

The Master Plan for the Construction of Hainan Free Trade Port (《海南自由贸易港建设总体方案》) and the Law of the People's Republic of China on Hainan Free Trade Port (《中华人民共和国海南自由贸易港法》) have established fundamental policies and institutional framework to realize the free and convenient trade, investment, cross-border capital flow, entry and exit of personnel and transportation, and the safe and orderly flow of data. The Regulations further elaborate on the investment promotion measures in the abovementioned areas, with a particular reference to the cross-border capital and data flows which are significant to the operation of FIEs, including:

-

to encourage financial institutions to adopt innovative measures in light of the needs of FIEs in respect of the free and convenient cross-border capital flow and foreign exchange for investment and financing, including the opening of multi-functional free trade account ("EF Account") for qualified FIEs established in Hainan FTP, and to support MNCs to set up cross-border treasury operation centers in the Hainan FTP.

-

to establish a safe and orderly cross-border data flow management system, facilitate cross-border flow of R&D, production, sales and other data of FIEs in a safe and orderly manner, and data flow between FIEs and their headquarters.

1. Cross-border Capital Flow and Foreign Exchange

(1)EF Account

The EF Accounts[8] has been implemented in Hainan FTP since May 6, 2024, which provide eligible applicants with various financial services, such as cross-border fund settlement, remittance, investment and financing. Depending on the identities of account holders, EF Accounts are further classified into EFE accounts (applicable for institutions established in Hainan FTP), EFN accounts (applicable for overseas institutions), EFF accounts (applicable for overseas individuals) and EFU accounts (applicable for overseas financial institutions and other eligible domestic financial institutions).

Cash flow via the EF Accounts shall adhere to following principles:

-

free flow crossing the "first line": funds in the EF Accounts could be freely transferred between EF Accounts and other overseas accounts (incl. OSA accounts, NRA accounts and EF accounts) upon payment instructions;

-

cross-border management crossing the "second line": funds remittance between the EF Accounts and other domestic accounts is limited to trading in goods and shall be subject to existing foreign exchange related rules in terms of cross-border payment, including application to bank with supporting underlying contracts;

-

limited two-way free flow between the EFE accounts and the same-name domestic RMB accounts opened in Hainan FTP's banks: within the limit of the company's ownership interest, funds remittance between such two accounts is free provided that use of funds therein shall not violate the restriction imposed by the "negative list"[9].

FIEs in the Hainan FTP could use the EFE account in various scenarios, such as borrowing foreign debts, conducting overseas lending, which are not subject to foreign exchange registrations or approvals currently applicable to other domestic ordinary accounts.

(2)Equity Investment and Reinvestment

Hainan FTP encourages qualified foreign investors to establish holding companies dedicated in making equity investment in China and has removed restrictions on foreign-invested holding company's use of domestic loans in equity investments thereby smoothing set-up of regional headquarters by MNCs in China.

Further, provided that the foreign-funded investment companies comply with the negative lists for foreign investment access and the domestic investment projects are authentic and in compliance with law, when foreign-funded investment companies reinvest in China with foreign exchange capital or RMB funds converted from foreign exchange settlement, the invested enterprises are not required to go through the foreign exchange registration procedures for receiving domestic reinvestment.[10]

2. Cross-Border Data Flow

(1) Hainan Negative List for Cross-Border Data Flow

Cross-border data flow is significant to MNC's business operation. The safe and orderly flow of data is one of Hainan FTP's fundamental policies. The Law of the People's Republic of China on Hainan Free Trade Port (《中华人民共和国海南自由贸易港法》) expressly support Hainan FTP to explore regional arrangements for cross-border data flow. In 2024, the Cyberspace Administration of China authorizes pilot free trade zones to, under the national framework of data classification and grading protection system, formulate negative lists of data applicable within relevant zones which are subject to management of security assessment for cross-border transmission, standard contracts for cross-border transmission of personal information, or protection authentication for personal information. Transmission of data outside of relevant negative lists could be exempted from the aforementioned management measures. On February 8, 2025, the Data Outbound Transmission Management List (Negative List) for Hainan Free Trade Port (2024 Version) has been issued which, in light of Hainan FTP's signature industries, outlined data outbound transmission scenarios for five industries (i.e., deep-sea, aerospace, seed, tourism and duty-free retail business), and set forth negative list and detailed requirements in each scenario.

(2) Infrastructure Connecting Global Internet

In 2020, the Ministry of Industry and Information Technology approved the construction of a dedicated channel connecting international Internet in Hainan FTP. Enterprises in the Hainan FTP could apply for access to such dedicated channel enabling direct access to the global Internet and seamless data exchange between domestic and the overseas. On February 19, 2025, the Hainan Cross-Border Data Service Center has officially launched, ready to handle related applications for cross-border businesses.

Ⅲ. Refined Services for Foreign Investment

The Hainan FTP has been refining services provided to foreign investors, including the following notable highlights:

1. FIE Incorporation

The Regulations aim to further facilitate the registration of FIEs, by simplifying registration procedures, cutting processing time, reducing costs and implementing a fully electronic end-to-end processing for eligible applicants. In respect of certain application materials required for establishment of FIEs relating to the foreign investor's incorporation certificates or identity certificates, eligible applicants may be exempted from notarization, authentication, or apostille.

2. Entry and Exit of Personnel

Hainan FTP has expanded its visa-free entry policies, extended the permitted stay and provided convenient measures for foreign investors and FIEs engaging in talent exchanges, business negotiations, enterprise operation and site visits. Based on the visa-free entry policies of the Hainan FTP for persons from 59 countries, as well as nationwide bilateral mutual visa-free entry policies (for 27 countries) and unilateral visa-free entry policies (for 47 countries), persons holding ordinary passports from a total of 85 countries may enter Hainan FTP without a visa. Among the 59 visa-free countries applicable in Hainan FTP, 11 countries are not covered by the nationwide bilateral visa-free or unilateral visa-free policies, including: Canada, Czech Republic, Indonesia, Lithuania, Mexico, Philippines, Russia, Sweden, United States, United Kingdom and Ukraine.[11]

The Regulations also allow the spouses and minor children accompanying the FIEs' internal seconded experts to enjoy the same duration of entry and temporary stay with the relevant experts. Senior officer engaging in preparation of branch/subsidiary establishment in Hainan FTP, together with his/her accompanying spouse and minor children, will also enjoy extended duration of temporary-entry.

3. Import and Export of Goods

In addition to measures relating to customs guiding qualified FIEs to apply for Authorized Economic Operator (AEO) and the provision of corresponding clearance facilitation, the more pivotal measures include a series of preferential customs policies to be implemented as of December 18, 2025 upon the official launch of special customs supervision zone in Hainan FTP. FIEs in Hainan FTP will also equally benefit from these policies:

-

Zero Tariff: imported goods not in the Catalogue of Taxable Imported Goods for Hainan FTP will be exempted from import duties, import VAT, and consumption tax upon entering Hainan FTP. This policy has covered approximately 74 % of all tax items of imports. Nevertheless, for goods that have been imported under "Zero-tariff" or finished goods thereof, upon entering the mainland from the Hainan FTP, import duties, import VAT, and consumption tax of the originate imported materials or components shall be paid back unless they are eligible for the following duty-exemption policy;

-

Duty-Exemption Policy for Processed and Value-added Goods[12]: in respect of goods produced by enterprises within the encouraged category of industry, if such goods are made of imported materials or components and the processing within Hainan FTP resulting in value added no less than 30%, upon entering the mainland from the Hainan FTP, import duties will be exempted as well (but import VAT, and consumption tax will still be levied).

Concluding Remarks

Hainan FTP will officially launch the island-wide independent customs operation on December 18, 2025 and switch to a special customs supervision zone. Aiming to lead high standard opening up and develop a high-level free trade port with Chinese characteristics, Hainan FTP has already and will continue to formulate a series of supporting policies to further promote foreign investment and operation in Hainan FTP.

Strategically positioned in the Hainan FTP with dual offices in Haikou and Sanya, KWM is at the forefront of the Hainan FTP's accelerated drive toward its landmark island-wide independent customs operation on 18 December 2025 - a pivotal milestone unlocking unprecedented market access and regulatory innovation. Leveraging real-time policy insights and in-depth knowledge in the China market, we empower global enterprises to seize investment opportunities, build compliant operational frameworks for the new customs regime, and secure first-mover advantage in Asia’s most dynamic economic gateway, ultimately transforming Hainan FTP's regulatory innovation into your sustainable competitive advantage.

Footnotes:

[1] The National Negative List comes into force from November 1, 2024 and is applicable to all FIEs outside of pilot free trade zones or Hainan FTP.

[2] The Hainan FTP Negative List comes into force from February 1, 2021, and is applicable to FIEs in the Hainan FTP. Besides the National Negative List and the Hainan FTP Negative List, currently there is also a Special Administrative Measures (Negative List) for Foreign Investment Access in Pilot Free Trade Zones (2021 Version) (《自由贸易试验区外商投资准入特别管理措施(负面清单)(2021年版)》), which comes into force from January 1, 2022 and is applicable to FIEs in pilot free trade zones

[3] The Notice of the Ministry of Industry and Information Technology on the Pilot Program for Expanding the Opening up of Value-added Telecommunications Services (《工业和信息化部关于开展增值电信业务扩大对外开放试点工作的通告》), promulgated and implemented by the Ministry of Industry and Information Technology on April 8, 2024.

[4] The Notice of the Ministry of Commerce, the National Health Commission and the National Medical Products Administration on Expanding the Opening-up Pilot Program in the Medical-related Sector ( (《商务部 国家卫生健康委 国家药监局关于在医疗领域开展扩大开放试点工作的通知》), promulgated and implemented by the Ministry of Commerce, the National Health Commission and the National Medical Products Administration on September 7, 2024. In addition, the Opinions of the State Council on Further Optimizing the Environment for Foreign Investment and Strengthening Efforts to Attract Foreign Investment (《国务院关于进一步优化外商投资环境加大吸引外商投资力度的意见), promulgated and implemented on July 25, 2023, explicitly states that “encourage foreign-invested enterprises to carry out clinical trials of cell and gene therapy drugs that have been marketed overseas within the territory of China in accordance with the law”. The Action Plan for Steady Promotion of High-level Opening-up to Attract and Utilize Foreign Investment (《扎实推进高水平对外开放更大力度吸引和利用外资行动方案》), promulgated and implemented by the General Office of the State Council on February 28, 2024, mandates that “allow Beijing, Shanghai, Guangdong and other pilot free trade zones to select a number of eligible foreign-invested enterprises to expand the pilot opening-up in the fields such as the development and application of genetic diagnosis and therapy technologies."

[5] The Notice of the Ministry of Commerce, the National Health Commission and the National Medical Products Administration on Carrying out a Pilot Program for Expanding Opening-up in the Medical-related Field (《商务部 国家卫生健康委 国家药监局关于在医疗领域开展扩大开放试点工作的通知》). In addition, the Notice of National Health and Family Planning Commission & Ministry of Commerce on a Pilot Scheme for the Establishment of Wholly Foreign-owned Hospitals (《国家卫生计生委、商务部关于开展设立外资独资医院试点工作的通知》), promulgated and implemented on July 25, 2014, allows foreign investors to establish wholly foreign-owned hospitals through establishment or acquisition in Beijing, Tianjin, Shanghai, Jiangsu, Fujian, Guangdong, and Hainan, while providing for specific establishment requirements.

[6] The Provisional Measures on Domestic Equity Investment in Hainan Province by Qualified Foreign Limited Partners (QFLP) (《海南省关于开展合格境外有限合伙人(QFLP)境内股权投资暂行办法》), promulgated and implemented by Hainan Local Financial Regulatory Administration, Hainan Provincial Administration for Market Regulation, Haikou Central Sub-branch of the People's Bank of China, and Hainan Branch of the China Securities Regulatory Commission on October 10, 2020.

[7] For further details on the Pilot Program, please refer to KWM's article, "Hainan FTP: Expanding Foreign Access to China's Asset Management" https://www.kwm.com/cn/en/insights/latest-thinking/hainan-ftp-new-chapter-to-broaden-foreign-participation-in-chinese-financial-market.html

[8] On April 3, 2024, the Hainan Branch of the People's Bank of China officially promulgated the Administrative Measures for Multi-functional Free Trade Account Business in Hainan Free Trade Port (《中国人民银行海南省分行关于印发<海南自由贸易港多功能自由贸易账户业务管理办法>的通知》), with effect from May 6, 2024.

[9] Restricted usages under the "Negative List" include: (1) the funds shall not, directly or indirectly, be used for the expenditure beyond the business scope or prohibited by national laws and regulations; (2) unless otherwise provided, the funds shall not be used, directly or indirectly, for securities investment or other investment and financing (except for asset management products and structured deposits with a risk rating of not higher than level 2); (3) unless it is expressly permitted in the business scope, the funds shall not be used for granting loans to non-affiliated enterprises; and (4) the funds shall not be used for constructing or purchase of real estate not for its own use.

[10] The Notice of National Development and Reform Commission and Other Departments on Implementing Several Measures for Encouraging Foreign-Invested Enterprises to Reinvest in China (《国家发展改革委等部门关于实施鼓励外商投资企业境内再投资若干措施的通知》), promulgated and implemented on July 7, 2025.

[11] For details, please refer to the article "Policy Introduction| Persons from 85 Countries May Enter into Hainan FTP without A Visa” https://mp.weixin.qq.com/s/IQzx495zrzDoZYUVVsnYXA

[12] For details, please refer to KWM’s article "Hainan FTP: Duty Exemption for Processed and Value Added Goods” https://www.kwm.com/cn/en/insights/latest-thinking/hainan-ftp-duty-exemption-for-processed-and-value-added-goods.html

Source: King & Wood Mallesons

Authors:

- Wang Lixin, Partner, Corporate & Commercial Group, wanglixin1@cn.kwm.com, Areas of Practice:mergers and acquisitions and foreign direct investment in the PRC

- Liu Xiaoping, Partner, Corporate & Commercial Group, liuxiaoping@cn.kwm.com, Areas of Practice:corporate, M&A and private equity. She is experienced in cross-border merger and acquisitions, outbound investment, foreign direct investment in the PRC and joint ventures

- Zhang Feifei, Lead Associate, Corporate & Commercial Group

- Gu Yitao, Corporate & Commercial Group