In Foreign Investment via Hainan FTP: Dive into New Era (I), we have highlighted the comparative advantages and recent progresses of the Hainan Free Trade Port's ("Hainan FTP") policies in terms of facilitating foreign investment in China. In this article, we will discuss key factors necessary and vital for foreign investment and the operation of foreign-invested enterprises ("FIEs"), with a focus on exploring potential opportunities and scenarios which may utilize Hainan FTP's foreign investment related policies to the most extent.

I. Hainan FTP's "Policy Infrastructure" for Foreign Investment

Foreign investment as a "systematic project" highly depends on underlying "infrastructures" which establish a robust institutional framework to underpin the operation of FIEs. Those critical "infrastructures" comprise of multiple legal regimes, including among others, foreign exchange (governing cross-border fund flows), tax (with impact on profit distribution), customs (managing import and export of goods and raw materials), data (involving cross-border information exchange), and other investment protection measures.

1. Foreign Exchange – Facilitating Cross-border Fund Flows

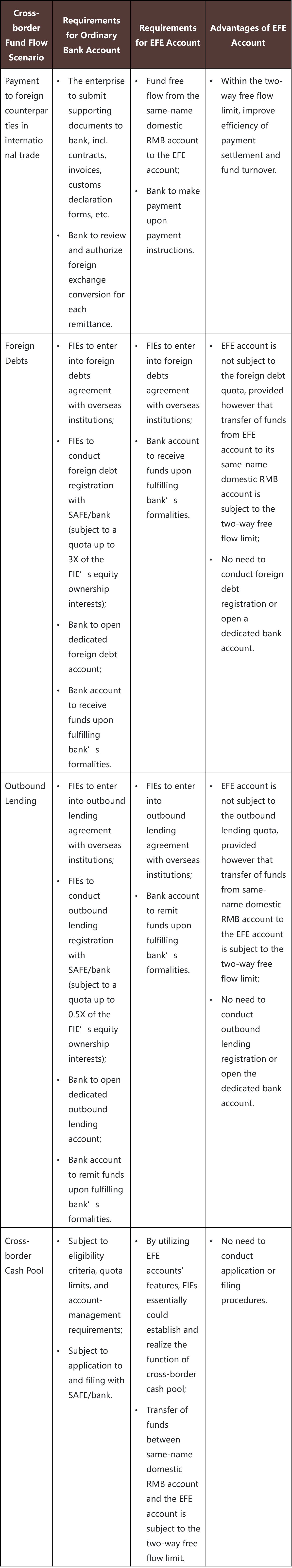

Establishment and daily operation of FIEs involve numerous scenarios of cross-border fund flows, such as, foreign shareholder's capital contribution, foreign exchange conversion for onshore use, foreign debt borrowed from foreign entities, FIE's outbound lending to foreign shareholders, cross-border cash pooling, and dividend remittance. Under China's foreign exchange legal regime, foreign direct investment ("FDI") by overseas investors in China is subject to registration with and administration by the State Administration of Foreign Exchange ("SAFE"). SAFE, via processing banks, supervises and manages FIEs' FDI registrations, foreign exchange accounts opening, buying and selling of foreign exchange, and cross-border remittance, etc. As a general principle, banks will require FIEs to submit supporting documents evidencing authenticity of the underlying transactions when handling any activities involving foreign exchange.

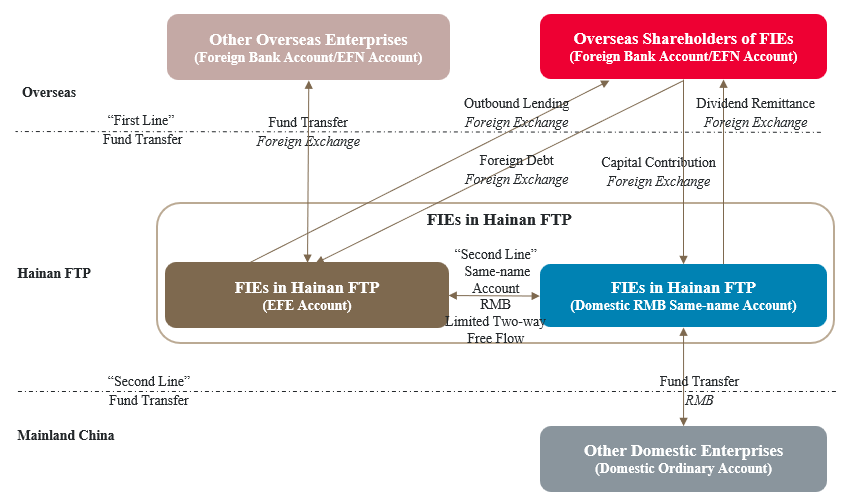

Aiming to facilitate free and convenient trade, investment and cross-border fund flow, the multi-functional free trade account ("EF Account") has been launched within Hainan FTP starting from May 6, 2024, which could ease foreign exchange restraints and enable eligible entities to enjoy more convenient financial services in cross-border fund flow scenarios. EF Account has the following key features:

-

EF Account is available to both PRC domestic enterprises incorporated in Hainan FTP (including FIEs established in Hainan FTP, which could open EFE account) and overseas institutions (which could open EFN account). The FIEs established in Hainan FTP could also open a same-name domestic RMB account;

-

free flow crossing the "first line": funds in the EF Accounts (including EFE account and EFN account) can be freely transferred in foreign currencies between EF Accounts and other overseas accounts upon payment instructions (namely, no need to submit supporting documents to the banks evidencing authenticity of the underlying transactions);

-

cross-border management crossing the "second line": funds remittance between the EF Accounts and other domestic accounts shall use RMB and is limited to trading in goods and subject to existing foreign exchange related rules in terms of cross-border payment, including application to bank with supporting underlying contracts;

-

limited two-way free flow between the EFE accounts and the same-name domestic RMB accounts opened in Hainan FTP's banks: within the limit of the company's ownership interest, funds remittance in RMB between such two accounts is free provided that use of funds therein shall not violate the restriction imposed by the "negative list"[1].

Below we set forth an illustration chart showing various cash flows in FIE's daily operation and the recommended use of EFE account among those cash flow scenarios:

The use of EFE accounts could facilitate FIEs' payment settlement in cross-border trade and inward/outward fund remittance in cross-border financing. The table below set forth EFE accounts' advantages in the aforementioned scenarios as compared with the ordinary bank account:

2. Tax – Lower Corporate Income Tax

The corporate income tax rate in China is 25%. The Hainan Free Trade Port Law of the People's Republic of China stipulates that "eligible enterprises registered in the Hainan Free Trade Port will enjoy preferential corporate income tax treatment, and eligible individuals will enjoy preferential individual income tax treatment." Consequently, enterprise registered in the Hainan FTP (including FIEs registered therein) will be entitled to a preferential corporate income tax rate of 15%[2], provided that the enterprise is engaging in encouraged industries and conducting substantive operations in the Hainan FTP.

Given dividends distributable to the FIE's shareholders shall be the FIE's after-tax profits, a lower corporate income tax rate will leave the FIE with more earnings available for distribution. To remit such dividends, FIE shall submit a written application to the bank, together with supporting documents, including among others, the shareholders' resolution approving the dividend distribution, audited financial statements, and the tax payment certificate issued by the competent tax authority. Foreign investors, as non-resident enterprises, are subject to a 10% withholding tax on dividends distributions, which rate may be further reduced according to applicable tax treaties (if any) between China and the country/region where the foreign investor is incorporated.

To qualify for the 15 % corporate income tax rate, an enterprise (including a FIE) incorporated in the Hainan FTP shall satisfy both of the following conditions:

-

Engaging in encouraged industry: which means that the enterprise's principal business shall fall within the encouraged industries catalogues applicable in the Hainan FTP[3], and its revenue generated from such principal business shall account for no less than 60% of its total revenue.

-

Conducting substantive operations in Hainan FTP: which means that the enterprise's management function shall be hosted in Hainan FTP, exercising substantive and overall management and control over the enterprise's production and operation, staff, accounting, assets, etc.

3. Import and Export – "Zero Tariff" & "Duty-Exemption Policy for Processed and Value-added Goods"

In addition to the corporate income tax, enterprises incorporated in Hainan FTP (including FIEs) may also utilize the "Zero Tariff" and "Duty-Exemption Policy for Processed and Value-added Goods" policies. After the official launch of special customs supervision zone in Hainan FTP, goods permitted for import into the Hainan FTP that are not listed in the Catalogue of Taxable Imported Goods for Hainan FTP[4] are exempted from import duties, import VAT, and consumption tax upon entering Hainan FTP. This policy will cover approximately 74 % of all tax items of imports. "Duty-Exemption Policy for Processed and Value-added Goods" refers to goods produced by enterprises incorporated in Hainan FTP within the encouraged category of industry, if such goods are made of imported materials or components (including bonded goods and "Zero Tariff" goods) and the processing within Hainan FTP resulting in value added no less than 30%, upon entering the Chinese mainland from the Hainan FTP, import duties will be exempted as well (but import VAT, and consumption tax will still be levied).[5] Regarding goods imported to Hainan FTP at "Zero Tariff", if such goods or the processed finished products thereof are subsequently transported from the Hainan FTP to the Chinese mainland (i.e., crossing the "second line"), import duties, import VAT, and consumption tax on the originating imported materials or components shall be levied if the 30% value-added threshold is not met.

If any "Zero Tariff" goods are also subject to measures relating to tariff quota, trade remedy, suspension of tariff concession obligations, imposition of additional tariffs, or imposition of additional tariffs for collecting retaliatory tariffs (unless such additional tariffs have been excluded) (collectively referred to as the "Four Measures"), the "Zero Tariff" policy and the implementation of the Four Measures will apply at the same time upon import to Hainan FTP (i.e., crossing the "first line"). When such "Zero Tariff" goods or their processed finished products entering the Chinese mainland, import duties, import VAT and consumption tax on the originating imported materials or components shall be levied, and the Four Measures will also be implemented (but will not be applied repeatedly if those measures have been already implemented).

4. Data – Direct Global Connectivity

From the legal and regulatory perspectives, under the national wide regime regulating cross-border data flows and the national data classification and grading protection system, Hainan FTP has been authorized to independently formulate a negative list applicable to data in Hainan FTP which are subject to specific measures in terms of cross-border transfer (including the security assessment for cross-border data transfer, standard contract for cross-border transfer of personal information, certification scheme for personal information protection, collectively referred to as "Cross-border Transfer Regulatory Mechanisms"). Entity processing data within Hainan FTP is exempted from these Cross-border Transfer Regulatory Mechanisms if transferred data do not fall within the negative list. Pursuant to the national wide regime and the negative list applicable in Hainan FTP, FIEs in Hainan FTP could be exempted from the Cross-border Transfer Regulatory Mechanisms under the following scenarios:

-

data collected or generated during the course of international trade, cross-border transportation, academic collaboration, transnational manufacturing or marketing activities, provided that those data provided overseas contain no personal information or important data;

-

personal information originally collected or generated overseas that is transferred to China for processing and subsequently provided overseas, and no domestic personal information or important data in China are introduced during the processing;

-

scenarios explicitly listed in applicable laws and regulations where personal information (excluding important data) is required to be provided overseas, such as concluding or performing contract in cross-border services to which an individual is a party; cross-border human resource management according to legally established labor regulations or legally executed employment collective contracts; or providing personal information abroad in an emergency to protect individual's life, health or property;

-

non-critical information infrastructure operators whose cumulative cross-border transfers of personal information remain below 100,000 individuals in a calendar year and do not include sensitive personal information;

-

data processors in pilot free trade zones provide data overseas outside the data negative list. The data negative list published by Hainan FTP has specified data subject to Cross-border Transfer Regulatory Mechanisms in Hainan FTP's five signature industries (i.e., deep-sea, aerospace, seed, tourism and duty-free retail business) and detailed requirements in each scenario.

From the infrastructure perspective, Hainan FTP has been constructing two international communication submarine cables: SEA-H2X Cable and Asia Link Cable, both of which will connect Hong Kong and Singapore. These will enhance Hainan FTP's international communication capacity, providing efficient and stable network support for cross-border transactions and real-time data transmission. In July 2024, the Ministry of Industry and Information Technology granted licenses to China Telecom, China Mobile, and China Unicom, formally approving the establishment of international telecommunication gateways in Haikou, making Hainan China's fourth province (after Beijing, Shanghai, and Guangdong) with gateways from all three major operators. Upon completion, this gateway will interconnect domestic and overseas carrier networks for seamless service interoperability and data exchange. Enterprises will gain direct access to the international internet via Hainan's local network, eliminating the need to route through intermediate nodes in Beijing, Shanghai, or Guangzhou.

II. Policy Mix and Business Opportunity Outlook

Based on the aforementioned preferential policies of Hainan FTP in respect of foreign exchange, tax, customs, and data transfer, taking into consideration of Hainan FTP's encouraged signature industries (tourism, modern services, high-tech industries, and tropical specialty high-efficiency agriculture), we set forth below a preliminary outlook on potential business opportunities for foreign investors and FIEs in Hainan FTP:

1. Regional Headquarters

To establish and operate regional headquarters of MNCs is one of the encouraged industries in Hainan FTP. Depending on the enterprise' registered capital, total assets of its parent company, number of companies subject to such enterprise's management, revenue, specific functions assumed by such enterprise, enterprises could be recognized as and qualified for various types of headquarters or functional institutions, including among others, the following:

-

FIEs conducting direct investment and being granted group mandates to manage multiple domestic and overseas subsidiaries;

-

entities entrusted with one or more regional (China, Asia-Pacific or broader) operating functions, such as sourcing, sales, treasury, R&D, manufacturing, product distribution, or services;

-

enterprise performing one or more national or regional functions in procurement, sales, logistics, distribution, cash management, general management, R&D, legal, human resources, etc.;

-

enterprise operating a cross-border centralized cash-management center.

Applicable policy mix:

-

enterprise engaging in encouraged industry is entitled to 15 % corporate income tax rate, which is to the benefit of intra-group shared services;

-

utilizing EF Accounts to streamline cross-border settlements and establish cash pools, enabling centralized management of domestic and overseas funds;

-

enterprises with the need of import and export trade may make use of "Zero Tariff" imports and engage in offshore trade.

2. Export-Oriented Digital Industries

The Provisions on the Development of International Data Centers in Hainan FTP (《海南自由贸易港国际数据中心发展规定》) encourage and support international data center operators to provide international data services such as gaming, film and television post-production, commercial aerospace, Beidou applications, cross-border e-commerce, cross-border live streaming, tourism, telemedicine, distance education, international academic exchanges, and multinational production and manufacturing. International data center services could be exempted from the Cross-border Transfer Regulatory Mechanisms if services involving only data storage, processing, or trading of data collected and generated overseas without introducing domestic personal information or important data or providing data overseas outside the data negative list.

Relevant business scenarios listed in the encouraged industries in Hainan FTP, including among others, the following:

-

development and operation of online education, telemedicine and remote-office platforms;

-

e-commerce retail and supply chains, including cross-border e-commerce;

-

production, distribution, trading, and derivative development of animation and games;

-

Research and development of technologies relating to satellite-based communications and application services in navigation, positioning, surveying and mapping, meteorology, geological exploration, and spatial information;

-

online tourism services.

Applicable policy mix:

-

enterprise engaging in encouraged industry is entitled to 15 % corporate income tax rate;

-

utilizing EF Accounts to facilitate cross-border settlements;

-

data provided overseas outside Hainan FTP's data negative list is exempted from Cross-border Transfer Regulatory Mechanisms

3. High Value-Added Manufacturing & Offshore Trade

Following the official launch of special customs supervision zone in Hainan FTP, imported goods not in the Catalogue of Taxable Imported Goods for Hainan FTP will be exempted from import duties, import VAT, and consumption tax upon entering Hainan FTP. In respect of goods produced by enterprises within the encouraged category of industry, if such goods are made of imported materials or components and the processing within Hainan FTP resulting in value added no less than 30%, upon entering the Chinese mainland from the Hainan FTP, import duties will be exempted as well (but import VAT, and consumption tax will still be levied). Enterprise with substantial room for value-added processing will benefit from such policy. Regarding enterprises engaging in offshore trade where both sourcing and sales markets are outside China, they could also benefit from the "Zero Tariff" policy by saving costs of fund occupation for tariff. Such enterprises may leverage the "Zero Tariff" policy for business relating to warehousing, picking, packing, sorting, transshipment and allocation, and data-processing services.

Relevant business scenarios listed in the encouraged industries in Hainan FTP, including among others, the following:

-

R&D and production of natural food additives, natural flavors, synthetic fragrances, etc.;

-

cosmetics research, development and production;

-

R&D and production of novel diagnostic reagents and cell therapy drugs;

-

advanced manufacturing;

-

gemstone processing and jewelry mounting;

-

novel offshore trade.

Applicable policy mix:

-

enterprise engaging in encouraged industry is entitled to 15 % corporate income tax rate;

-

utilizing EF Accounts to facilitate cross-border settlements;

-

"Zero Tariff" & "Duty-Exemption Policy for Processed and Value-added Goods".

III. Concluding Remarks

Hainan FTP will officially launch the island-wide independent customs operation on December 18, 2025 and switch to a special customs supervision zone. Aiming to lead high standard opening up and develop a high-level free trade port with Chinese characteristics, Hainan FTP has already and will continue to formulate a series of supporting policies to further promote foreign investment and operation in Hainan FTP.

Strategically positioned in the Hainan FTP with dual offices in Haikou and Sanya, KWM is at the forefront of the Hainan FTP's accelerated drive toward its landmark island-wide independent customs operation on 18 December 2025 - a pivotal milestone unlocking unprecedented market access and regulatory innovation. Leveraging real-time policy insights and in-depth knowledge in the China market, we empower global enterprises to seize investment opportunities, build compliant operational frameworks for the new customs regime, and secure first-mover advantage in Asia's most dynamic economic gateway, ultimately transforming Hainan FTP's regulatory innovation into your sustainable competitive advantage.

Footnotes:

[1] Restricted usages under the "Negative List" include: (1) the funds shall not, directly or indirectly, be used for the expenditure beyond the business scope or prohibited by national laws and regulations; (2) unless otherwise provided, the funds shall not be used, directly or indirectly, for securities investment or other investment and financing (except for asset management products and structured deposits with a risk rating of not higher than level 2); (3) unless it is expressly permitted in the business scope, the funds shall not be used for granting loans to non-affiliated enterprises; and (4) the funds shall not be used for constructing or purchase of real estate not for its own use.

[2] Circular Caishui [2020] No. 31 on Preferential Corporate Income Tax Policies for the Hainan Free Trade Port (《关于海南自由贸易港企业所得税优惠政策的通知》(财税〔2020〕31号)), issued by the Ministry of Finance and the State Taxation Administration on 23 June 2020 and effective retroactively from 1 January 2020, has been extended to 31 December 2027 by the Notice on Continuing the Implementation of the Preferential Enterprise Income Tax Policy for the Hainan Free Trade Port (《财政部税务总局关于延续实施海南自由贸易港企业所得税优惠政策的通知》).

[3] Such encouraged-sector industries include encouraged-sector industries listed in the Guidance Catalogue for Industrial Structure Adjustment (2024 Edition) (《产业结构调整指导目录(2024本)》) and various industries listed in the Catalogue of Encouraged Industries for Foreign Investment (2022 Edition) (《鼓励外商投资产业目录(2022版)》) and the Catalogue of Encouraged Industries in the Hainan Free Trade Port (2024 Edition) (《海南自由贸易港鼓励类产业目录(2024年本)》).

[4] The Notice on Tax Policies for Goods Entering and Exiting the "First Line", "Second Line", and Circulating within Hainan Free Trade Port (《关于海南自由贸易港货物进出“一线”、“二线”及在岛内流通税收政策的通知》), promulgated and implemented by People's Government of Hainan Province, Ministry of Finance Hainan Regulatory Bureau, Haikou Customs, Hainan Provincial Tax Service and State Administration of Taxation on July 18, 2025; the Notice on the Catalogue of Taxable Imported Goods for Hainan Free Trade Port (《关于海南自由贸易港进口征税商品目录的通知》), promulgated and implemented by Ministry of Finance, General Administration of Customs and State Administration of Taxation.

[5] The Interim Measures of the Customs of the People's Republic of China on Duty-Exemption Policy for Processed and Value-added Goods in Hainan Free Trade Port (《中华人民共和国海关对海南自由贸易港加工增值免关税货物税收征管暂行办法》), promulgated by General Administration of Customs on July 23, 2025, with effect from December 18, 2025.

Source: KING&WOD MALLESONS Law Firm

Authors:

- Wang Lixin, Partner, Corporate & Commercial Group, wanglixin1@cn.kwm.com, Areas of Practice:mergers and acquisitions and foreign direct investment in the PRC

- Liu Xiaoping, Partner, Corporate & Commercial Group, liuxiaoping@cn.kwm.com, Areas of Practice:corporate, M&A and private equity. She is experienced in cross-border merger and acquisitions, outbound investment, foreign direct investment in the PRC and joint ventures

- Zhang Feifei, Senior Associate, Corporate & Commercial Group

- Zhang Ziyu, Associate Assistant, Corporate & Commercial Group

READ MORE: Foreign Investment via Hainan FTP: Dive into New Era (I)